VITA: Volunteer Income Tax Assistance

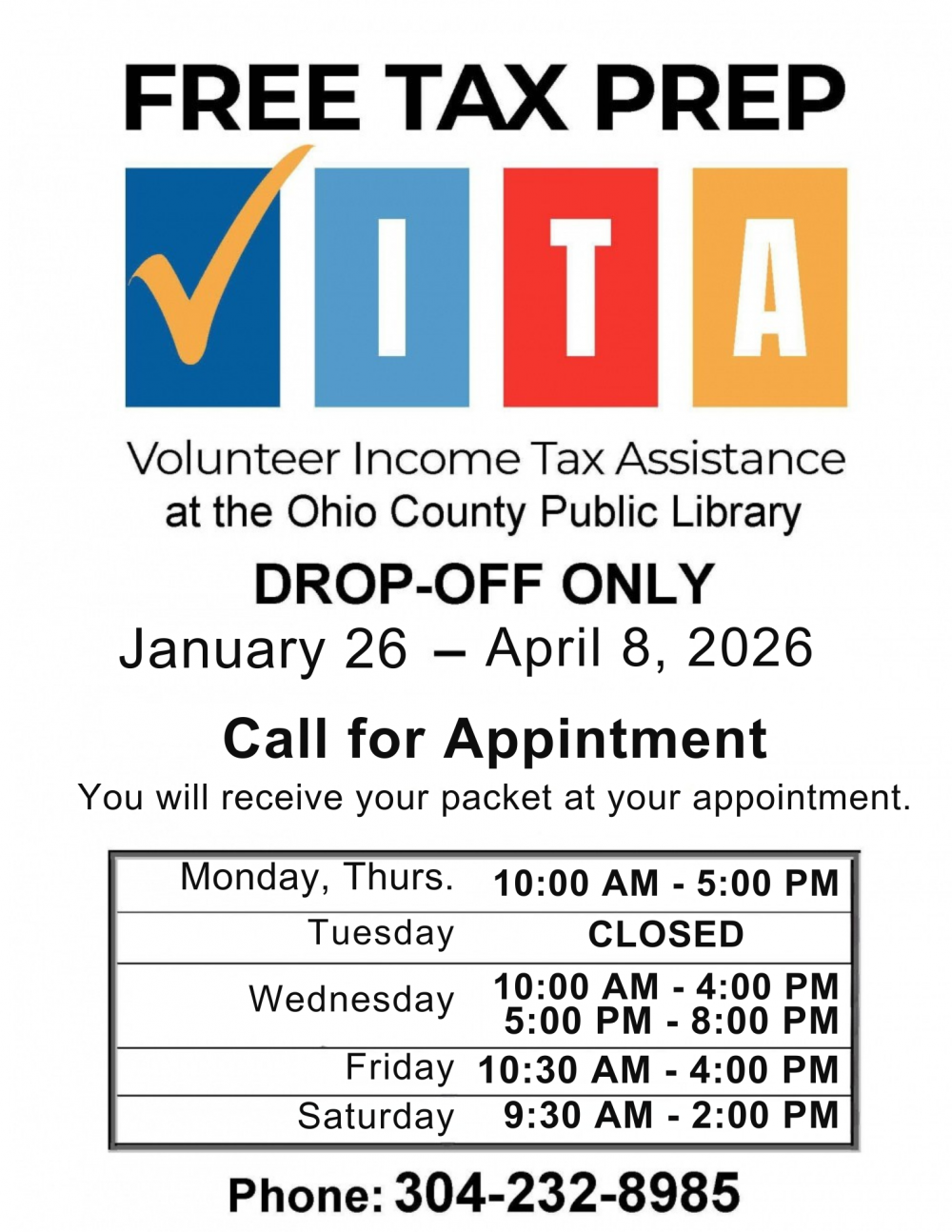

The Tax Service at the Library will begin this year on Monday, January 26. Taxes will be done by appointment only. Call 304-232-8985 to make an appointment. Intake packets will be available only at your appointment.

Visit https://vitaocpl.com/ for more information.

Free tax help is available every year at the Ohio County Public Library through the Volunteer Income Tax Assistance (VITA) Program. This is a volunteer service and not a part of the Library. Though VITA sets up its service in the Library every year, VITA is not a Library program or service. They are an organization independent of the Library. Library staff do not have access to any of the tax information or records and cannot answer questions related to the VITA program. All questions regarding the VITA program must be directed to the on-site VITA volunteers during their open hours at 304-232-8985. Visit https://vitaocpl.com/ for more information.

Want to keep up with all the latest Library news and events?

Want to keep up with all the latest Library news and events?